Don’t reinvent user profiling during onboarding. This is what it should look like.

How to get the first-party data you 100% need to have.

This post is brought to you by the all-new Ahrefs Starter Plan: Now, you can get access to one of the best Marketing Intelligence Platforms for a new, lower price—just $29/month. Perfect for beginners or marketers on a budget who still want premium insights. Learn more, here!

Everyone understands (I hope?) the value of having demographic/firmographic user data—knowing details like the company they work for, their role, their seniority, and their use case. So instead of treating everyone the same, this information becomes the backbone of your product and GTM efforts, as it helps you identify who you are acquiring and determine the best strategies to engage and monetize them effectively.

That’s important for both your company and the user - you don’t want to send salespeople after a college student any more than that college student wants to get enterprise pitches in their inbox.

By understanding who the users are, you can also optimize correctly. For instance, if someone points out that your activation rate is 20% against a benchmark of 40% - is that for every segment? Or is that 40% only supposed to be within your target ICP? First-party data will allow you to confirm who actually fits, and whether the drop-off is actually concerning.

This article is about how to collect that user data, the right way.

First things first: You need first-party data

Getting the profile information directly from the user (aka ‘First-party data’) is the only way to go. Period. Yes, there are a lot of companies out there promising you ‘high quality’ user data, but it’s all a sham (there, I said it). Now, you may use third-party data to augment your first-party data source, but you should NEVER have it as your primary data source. Why? Quite simple, actually: in my experience, as much as 50-60% of third-party data is inaccurate. This means that if you collect the info directly from a user and compare it to what a third party tells you, it's wrong over half the time. Rates go up to 80-90% if you are dealing with consumers, freelancers, agencies, or SMB segments.

Of course some naysayers will raise their hand right about now, saying: ‘But Elena, first-party data is also faulty… people lie, put random answers, or skip it altogether.’ Yes, that is true. And you will see that ~15% of your first-party data will be bad. But 15% < 50% :)

Which means you will have to ask the user. Hence the importance of ‘user profiling.’

How to ask

How you ask makes a big big big difference. Asking the right questions in the right ways can have a huge impact on how much info you can collect and how many people will drop off.

After working with dozens of companies (and talking with hundreds more), I’ve realized: the skeleton structure of what works is exactly the same. Use this approach in this order, and you’ll pretty much guarantee a low dropoff (15%, at most).

About those dropoffs

Some people freak out about the possibility of 15% of their users dropping off in this flow. But here’s the thing: If a few questions scared a customer away, then they had such low intent they were never going to do anything in your product anyway. To better understand this, you have to optimize for the whole system, not just this individual step. Because that’s the wild thing: Even though there’s a 15% dropoff in the survey stage… the overall activation volume may/will go up!

Collecting user profiling information will not only get you the data to personalize the experience but will also boost the psychological momentum, increasing the likelihood of activation. As users progress, their investment grows. Even if the data isn’t used (which I highly do not recommend), the act of collecting it can still improve activation rates.

Profiling in 3 steps

Profiling works best when it's broken into 3 steps:

Tell us about yourself

Tell us about your company

Invite your team

Tell us about your use case

This is heavily tailored for B2B products with self-serve start, but B2C products can get the gist.

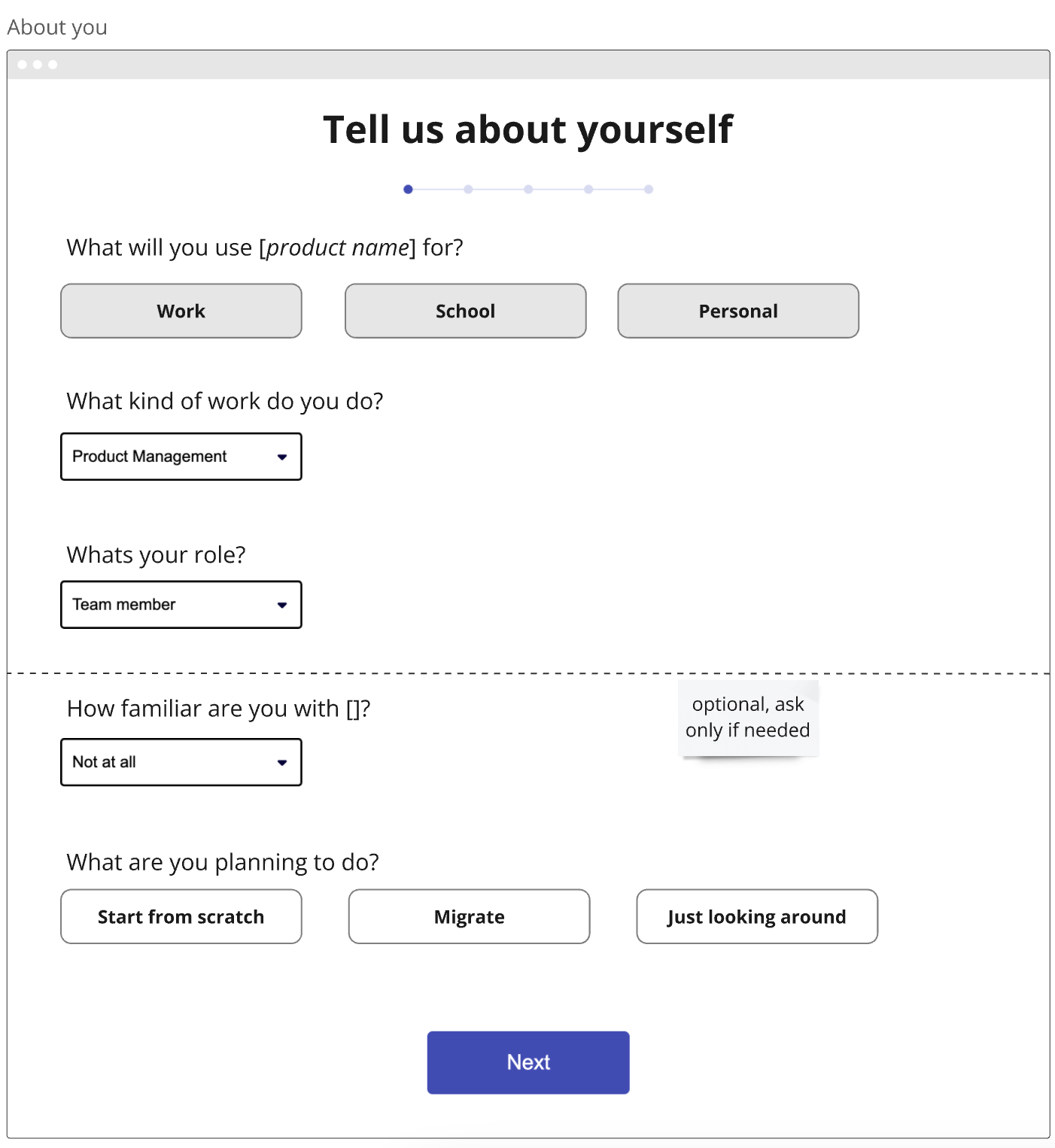

Step 1: Tell us about yourself

Here, focus on the information that you need to know about the customer. What is their intent (personal or professional), what is their role, seniority, familiarity with the tool, etc.

Some notes:

Question ‘What will you use [product] for?’: Self-serve products attract all sorts of sign ups - from students, to personal use, to actually professional use case. Not all products cater to personal use, but even technical ones like MongoDB may attract personal projects. For B2B products, identifying personal or non-ICP users helps refine your Ideal Customer Profile. Exclude these users from your free-to-paid conversion rate since they’re unlikely to convert. This allows you to focus on ‘monetizable users’. For instance, Slack targeted B2B-intent workspaces, calling them "Relevant Workspaces," and prioritized monetizing them.

Question ‘What’s your role?’: Knowing a customer's seniority is crucial for B2B companies. A decision-maker signing up, like an exec from the right department, is a strong sales signal—equivalent to submitting a lead form. Understanding their role helps you identify whether they're there to evaluate or actually use your product.

Question ‘What are you planning to do?’: For technical products, the initial experience varies significantly between starting from scratch and migrating. These are entirely different user problems. For example, a user migrating from a large company likely won’t be solved via self-serve experience and will require sales/success touch. This distinction serves as a proxy self-serve qualifier.

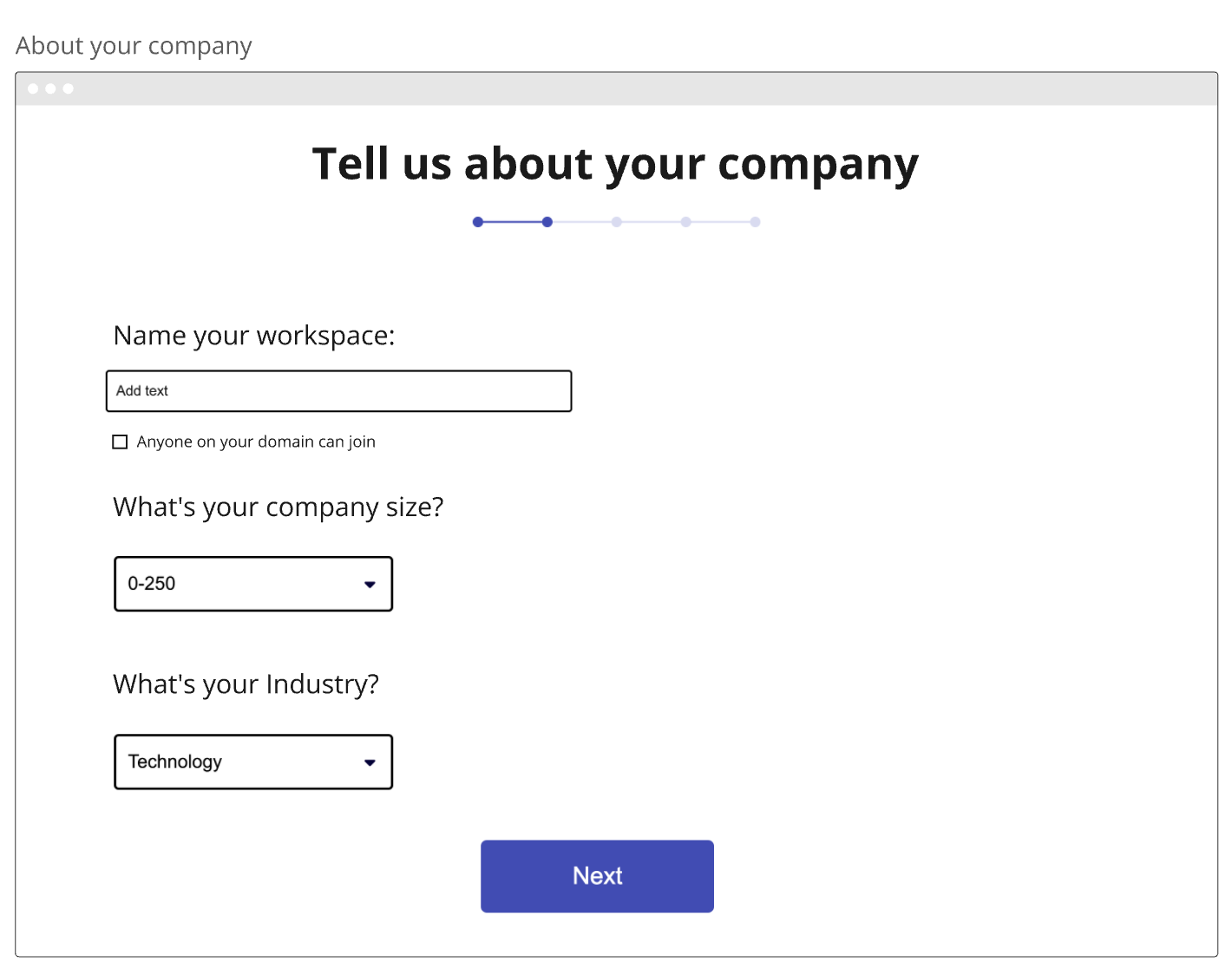

Step 2: Tell us about your company

This is a good compliment to the first screen and makes for a natural progression.

In terms of logic: Only show this if they chose ‘for business use’ on the first screen. As for specific questions:

Checkbox ‘Anyone on your domain can join’: This is very important!! This helps the team/workspace be discoverable to anyone else from their company who joins the platform. Obviously, you’ll never apply this to anyone with a Gmail or other webmail address, but on a corporate domain, you absolutely have to do it to help you grow internally within your customer’s company.

Question ‘What’s your company size’: Most companies use third-party data for this question and it is always oh-so-wrong… This question is important because it tells you what market segment you are dealing with. Usually, SMB is self-serve (what they are willing to pay cannot justify sales involvement), mid-market can go either way, and enterprise segment should have sales involvement.

This question is about the customer's ultimate destination, not just “self-serve vs. sales.” If someone joins from a large company, it doesn’t mean sales should reach out immediately—but it signals they’ll likely need sales later as they expand. Two coworkers collaborating in a small company are treated differently than those from a larger company, where the account becomes a lead to kickstart the process.

Question ‘What’s your industry’: Some sales teams may only want to work in certain industries, as part of their targeting criteria, to allow them to be as effective as possible. But if your sales team doesn’t do this, skip this one.

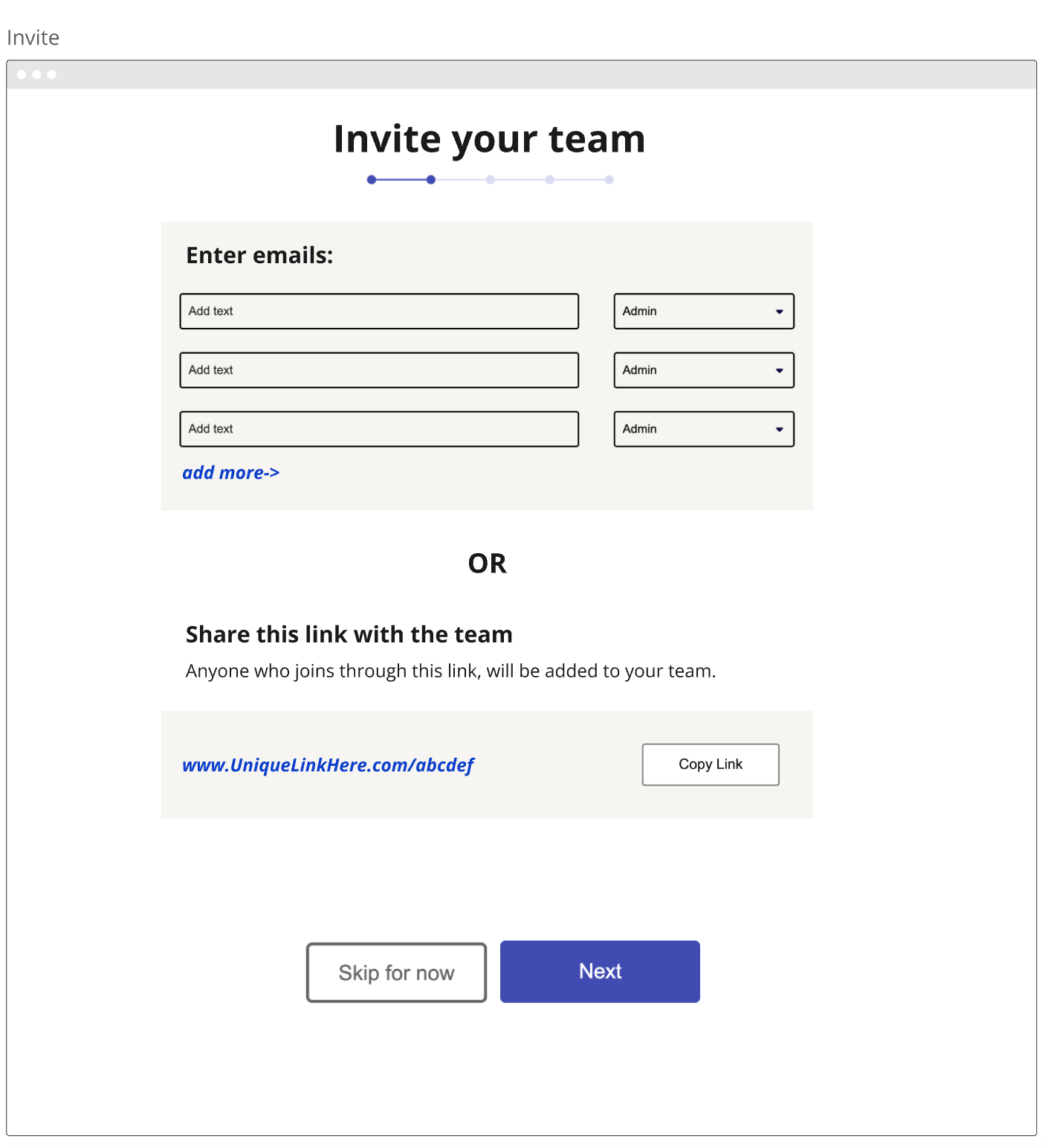

Step 3: Invite your team

Another B2B step - though potentially controversial - is encouraging new users to invite their team within onboarding flow. While brand-new signups might not do this, established products often attract repeat users. These users may already be sold on your product, switching companies, and ready to bring their team onboard.

But even without that factor: I recommend this as a permanent step in this process. Why? It creates brand awareness around your product’s multiplayer mode. You’d be surprised how many users don’t even consider a multiplayer element for new products they try, so just showing them this screen helps to nudge them in that direction.

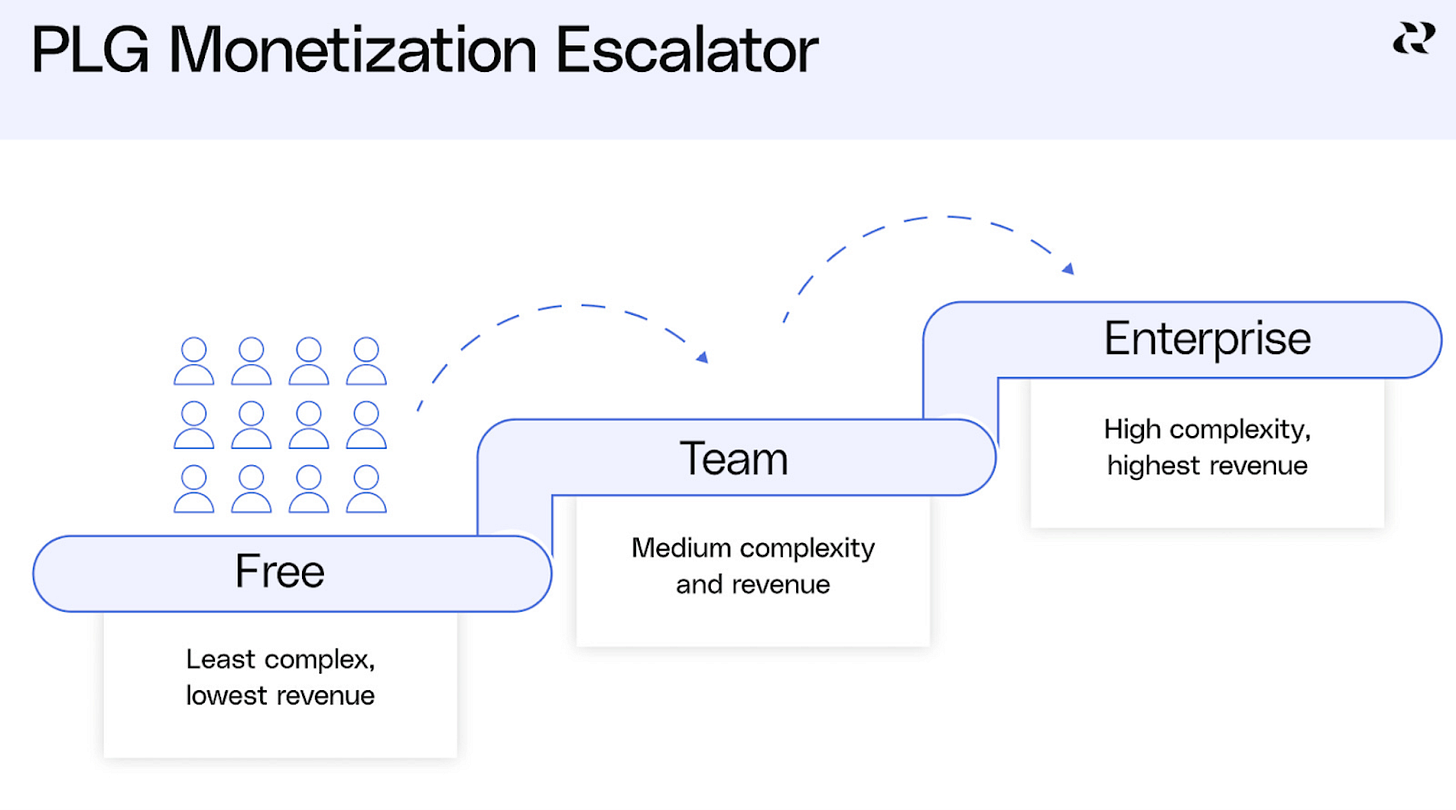

Why is multiplayer so important? Because even though you are acquiring a user, you should be activating a team, in order to sell to a company. I call this the Monetization Escalator—visualized here:

A few key nuances:

Use form logic, so you don’t show this to companies that are ≤2 people.

For the ‘Admin Role’ dropdown: You shouldn’t assume who people are inviting. Yes, whoever creates this account will be an admin, but it’s actually incredibly beneficial to have multiple admins within any account. It’s like creating multiple redundancies against failure - if the admin leaves the company, for instance. But it also streamlines things for users. If someone wants to join and requests access, multiple admins are available to approve.

Figma does an incredible job of this: When you request access to a Figma workspace, it shows all of the admins! I’ve had onboarding situations where I was able to get almost instant access because, out of all the admins, someone was immediately available to approve.

By defaulting to Admin and letting people change to User, you’ll increase the likelihood of getting this helpful redundancy.

Share a link: This step isn’t mandatory - it's only useful if you anticipate a large number of team members joining.

Step 4: What are you here to do?

I probably see this one the least, but it is so valuable. In some ways, it’s actually a product marketing step. Every user has a problem they’re looking to solve, but… that problem isn’t the only problem your product can solve. You are generally going to want to solve for more than what they initially want. And one major challenge is: creating awareness once the user is in the product is incredibly hard. Once they’re set in their Job-To-Be-Done, they will stay there. Removing the blinders on their expected use is super hard.

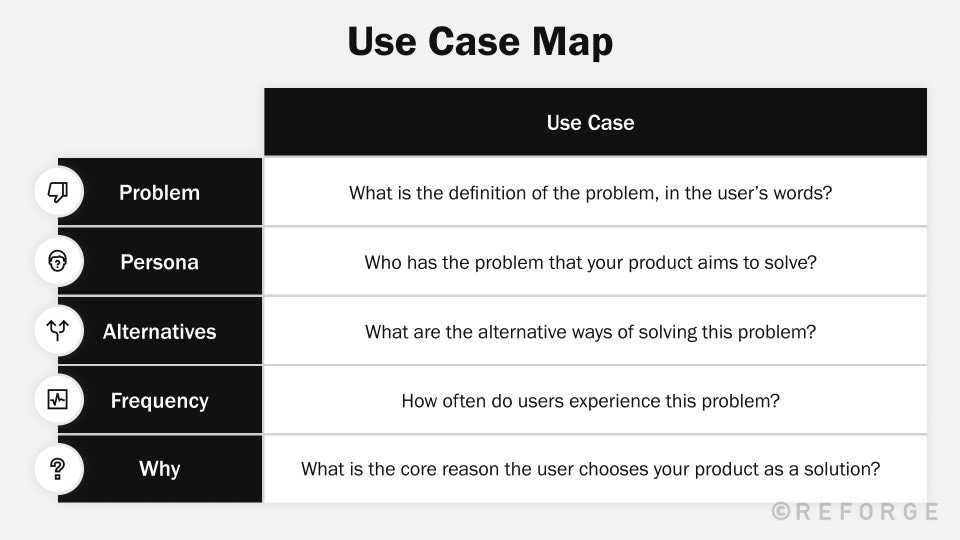

But… you can’t include 100 options. This has to be condensed. Personally, I love the Reforge’s Use Case Framework: The problem in the customer’s words, Persona, Alternative, Why they choose you, and Frequency of use.

Putting those together is a great way to expose new users to what your product is capable of.

Having this information is giving your Growth a huge boost:

Segment all activation & monetization by these use cases: See which ones you’re winning at—which JTBD are successful in various stages? Which ones are failing?

Real example: At Miro, people could use whiteboards for brainstorming, or they could use them for prototyping. These are very very different use cases… but they use the exact same elements. So, from Miro’s usage perspective, they look the same. But by asking this kind of profiling question, they learned which users were there for which use cases - and where they were winning.

Revenue attribution: Which use cases are bringing in the most revenue for you to have correct prioritization? Otherwise… how do you know?

Identify emerging use cases: Having this information is a great way for product (or even marketing) to see new potential uses for your product. Any answers in the “Something else” category is a key indicator that the market is looking for you to solve a new problem for them. This is the perfect place to derisk your roadmaps, by getting early validation.

A few pro tips

Only ask for what you will use. Questions may pop in and out of the onboarding profiling, but never keep a question that you are not using to segment your data, personalize communication, or inform your strategy.

Don’t make it too pretty! This is an information gathering exercise. Don’t make it beautiful or animated—that just distracts users. Again and again, I’ve seen design teams add visuals and backgrounds to these surveys, but it always reduces the completion rate. This performs best with a simple flow.

The only animation I would add: You can make the ‘Tell us about yourself’ section fold out gradually, as each step is completed—this keeps the button above the fold, while gradually introducing the questions.

Stay away from open-ended fields: Adding open-ended fields is the fastest way to kill your completion rate for these forms. Typing is hard. People don’t want to do it. And even if they do, they’re often bad at it. It makes data aggregation hard on the back end. Instead, just do radio buttons or drop-downs.

That’s it! Use this structure to gather your first-party user data and you’ll be good to go.

Would you like to sponsor my newsletter? Send an inquiry.

Edited with the help of Jonathan Yagel, Assistant to the Regional Memeger.

Thanks for the insightful article. Any thoughts on gathering first party data that’s is open ended?

I’m looking to build user profiles that include their goals, current projects, and challenges.

Great article 👏🏼