Elena’s 2024 B2B Product-Led Sales Guide

Everything you need to know about the new(ish) way to sell.

This post is brought to you by Attio, the next generation of CRM. Looking for a CRM? Attio is your best bet—you can get it set up right now. Join 25k Attio users and scale your startup to the next level.

How do you get started with Product-Led Sales?

This is perhaps the #1 question in B2B SaaS at the moment, as the wave of PLG companies matures and realizes the need for expanding beyond the self-serve motion.

The bad news is: There’s no easy answer.

The good news is: There is a practical way you can approach it… and you’re reading it.

In this guide, we’ll cover the following elements:

What is Product-led sales?

PLG Pre-Requisite

Market Segments

When should you start?

Self-Serve Product-Market Fit

Hand Raisers

Sales Floor

How do you produce more hand-raisers?

Awareness

Monetization Escalator

Differentiation: Product, Services, Process, Pricing

How to think about Product Qualified Accounts (PQAs)

Sales vs. Product ICP

Volume, Velocity, Breadth of Use, Behavioral

How to progress from PQA to PQL

Economic Buyer

Onboarding Profiling

Champions

Top-down Sales Tactics

How to Structure PLS Incentives & Timelines

ACV vs. Logo Quotas

Sales-led vs. Product-led sales timing

1. What is Product-Led Sales?

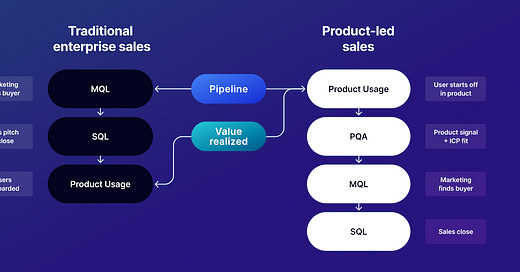

The Product-Led Sales (PLS) strategy is an expansion play on top of Product-led growth (PLG) strategy. The creation of product-led self-serve usage forms the foundation of the sales pipeline creation for product-led sales.

Product-led growth is characterized by a product's capacity to self-serve activate, engage, and monetize users. User must:

Be motivated to solve the problem

Have the ability to do it self-serve

Have permission from the organization to solve the problem

If you are wondering if PLG is right for you - check out my post: To PLG or not PLG.

Once product-led model is firing on all cylinders, product-led sales utilizes end-user self-serve usage as the basis for generating sales opportunities and leads. In contract, traditional enterprise sales consider usage the end goal of a successful contract.

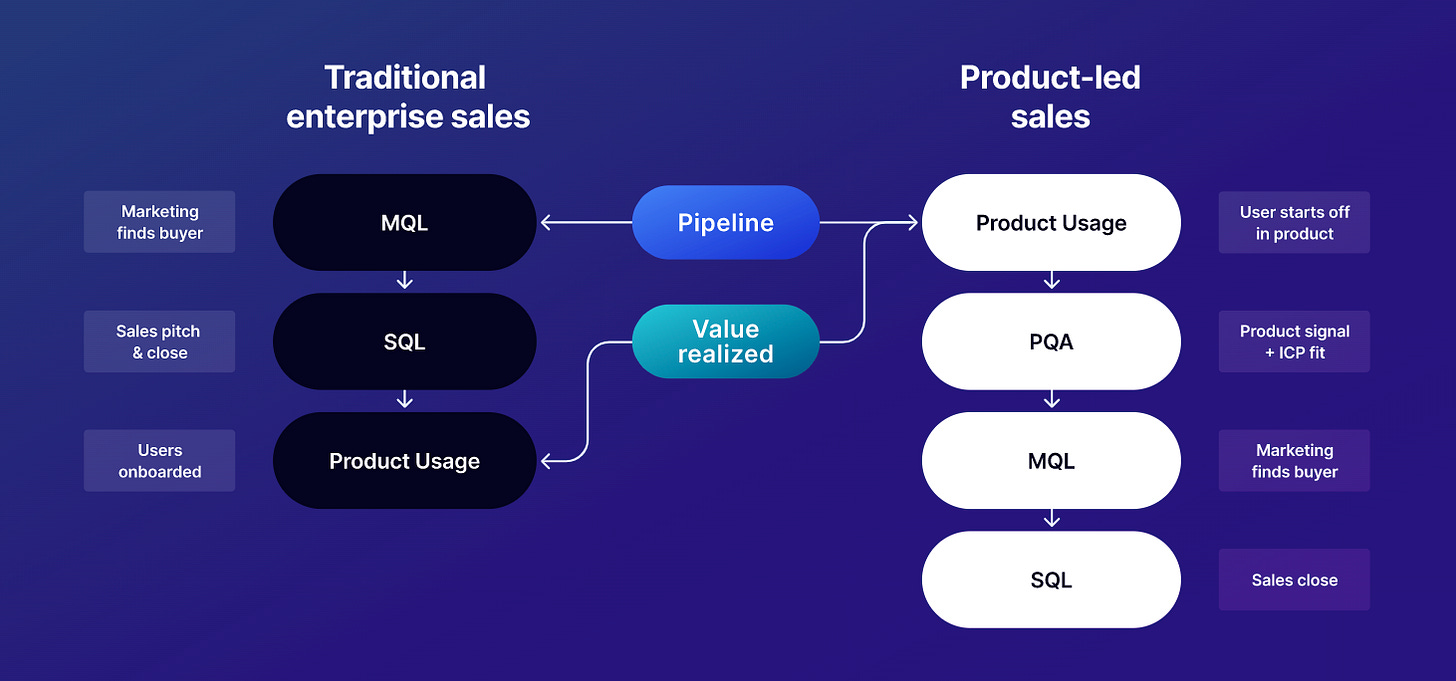

Product-Led Sales vs. Traditional Sales-Led Target Segments

Product-led sales and sales-led approaches excel in different segments, typically based on customer company size:

SMB (1-100 employees): Dominated by self-serve payment due to simpler problems and lower Average Contract Values (ACV), making it unprofitable to assign sales reps. This segment prefers a self-serve journey powered by PLG.

Mid-Market (101-1000 employees): Mid-market segment has undergone the biggest transformation, previously owned by traditional sales but now transitioning to product-led sales. Users have permission to try out products and the company is not tightly regulated yet - yet they can bear big enough ACV’s, making it lucrative and profitable for the sales motion.

Enterprise (1001+ employees): Predominantly traditional sales-led, due to strong budget control, high security demands, and lack of end-user motivation to solve enterprise-wide problems. Human intervention is often necessary for interest and pilot runs. However, product-led sales are starting to disrupt even enterprise segment, with companies like Figma, Miro, and Amplitude leading the way into enterprises through end-user, escalating to six-figure contracts with product-led sales.

2. When should you start?

So, what needs to be true for your company to start investing in Product-Led Sales (or PLS) as a strategy?

#1 - You already have Product-market fit with your self-serve B2B product

If you’re trying to find product-market fit (or PMF) with your sales team, you’re not doing PLS. You are just doing top-down sales. Nothing wrong with that, but that’s a different route to market.

PLS is anchored on the ability to use self-serve usage to generate a pipeline for sales.

#2 - You’re seeing Organic Hand-Raisers

What’s a hand-raiser? Someone in your self-serve user base who is submitting a sales form (or coming through social or support) saying, “Hey, I’d like to purchase more” for the whole team or company.

If you are starting to see your users hand-raise, that is the sign that PLS might be a path for you.

#3 - You’re able to clear ‘Sales Floor’

A ‘sales floor’ is the minimum amount an account needs to buy, to justify human/sales involvement.

Self-serve payments are usually $10, $15, $100 per month, which generally caps out at $10k/year or so. That’s when you start moving into the territory of needing budget approval, a Purchase Order, or just the fact that credit cards start to fail at those amounts.

Looking to buy anything above $10k is a very common initial ‘sales floor’ that organizations set because it creates a productive sales deal that is cost-effective for the company and is a good lift on top of their SS. This allows you to not lose money by adding a human component, which injects cost. When you see people requesting >$10k deals, that’s a final signal to start investing in PLS.

Important Notes:

(a) If you’re not seeing any hand-raisers and try to lay over a sales motion, it just falls flat. Trying to manufacture something that is not even seeing organic pull… not a good idea. Until you see hand-raisers, don’t even think about it.

Also: Hand-raisers are not coming to an actual sales team at your org… because you don’t have a sales team yet! So, they’re coming to customer support or reaching out on social. They’re big champions for your product. They’ll find you by any means possible.

(b) See if you can scale up gradually to your first sales rep: Sales reps are expensive! They can cost from $100K to $300K, so you need to produce 3x to 5x their salary in order for it to be a good investment. You should be building their initial pipeline through producing more hand-raisers. (Note: Depending on your stage, you may still be relying on your founders to do the selling—check out this post from Attio on how to transition out of founder-led sales.)

3. How do you produce more hand-raisers?

Always focus on scaling your hand-raisers first! Nothing is more beautiful than organic end-user demand ready and wanting to purchase more. Sales loooove these types of leads.

Sales Funnel Entries

To scale hand raisers to the max, create additional entry points into your sales funnel within the product:

Add a sales plan to your plans and pricing pages: “This is our business/enterprise plan… contact us.”

Put a “contact sales” option in the admin, product settings, and your billing/ subscription management section. Again, create awareness that there’s an opportunity to purchase moooore.

Think about contextual points. There are lots of these, so here are a few examples:

On an invite users screen: “If you’re looking to invite a bunch of users, would you like to talk to sales?” Or, any other volume metric that you have.

Or, a sign-in page: “Would you like to enable Single Sign On (SSO)? Contact sales.”

Or, on your support page: “Would you like a dedicated success manager? Contact sales.”

Or, an integrations page: “Want to connect these apps? Contact sales.”

Contextual points are particularly incredible as “feature walls” because they give a reason behind why the customer might want to contact sales. So, think about every single thing that is actually in your Enterprise plan—whether it’s just volume or whether it’s actual feature differentiation—and make sure that each one has a feature wall inside your self-serve product. Naturally, this feature can’t actually be unlocked via self-serve—it’s just a ‘painted door’ in your product that has contact sales call to action.

Create Monetization Escalator Via User Journey

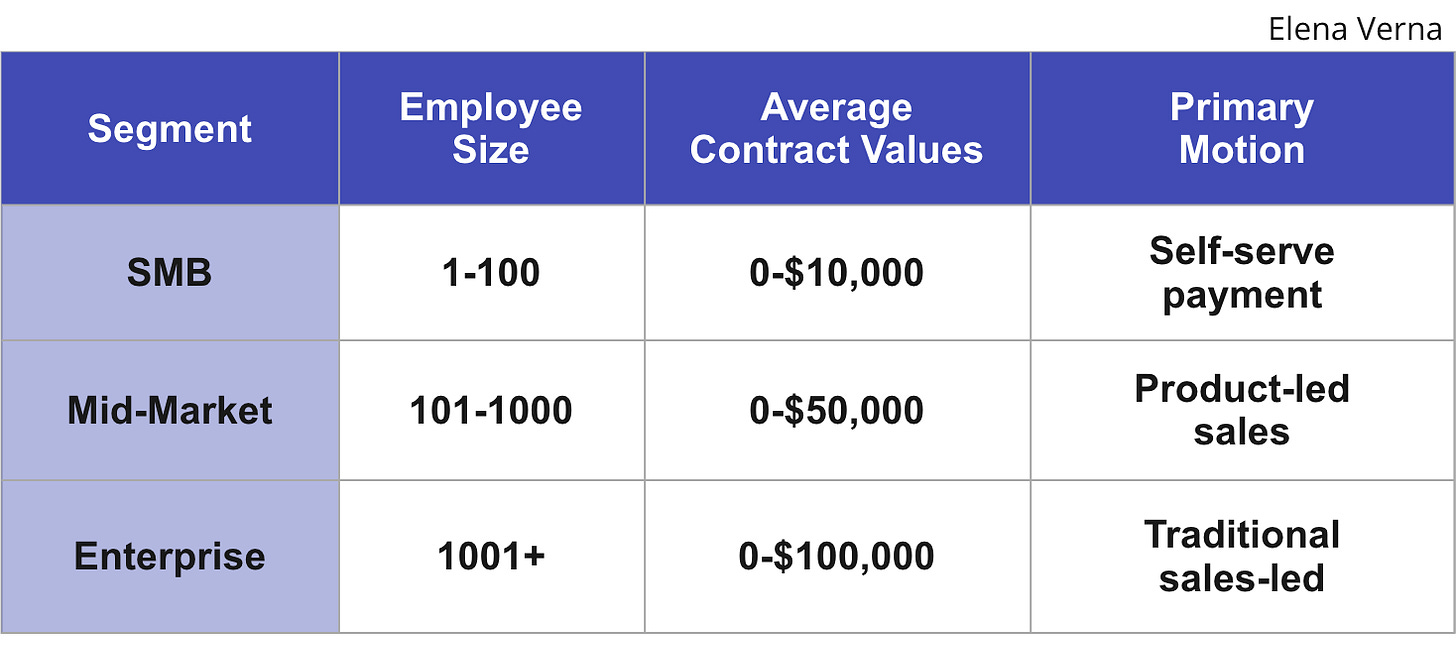

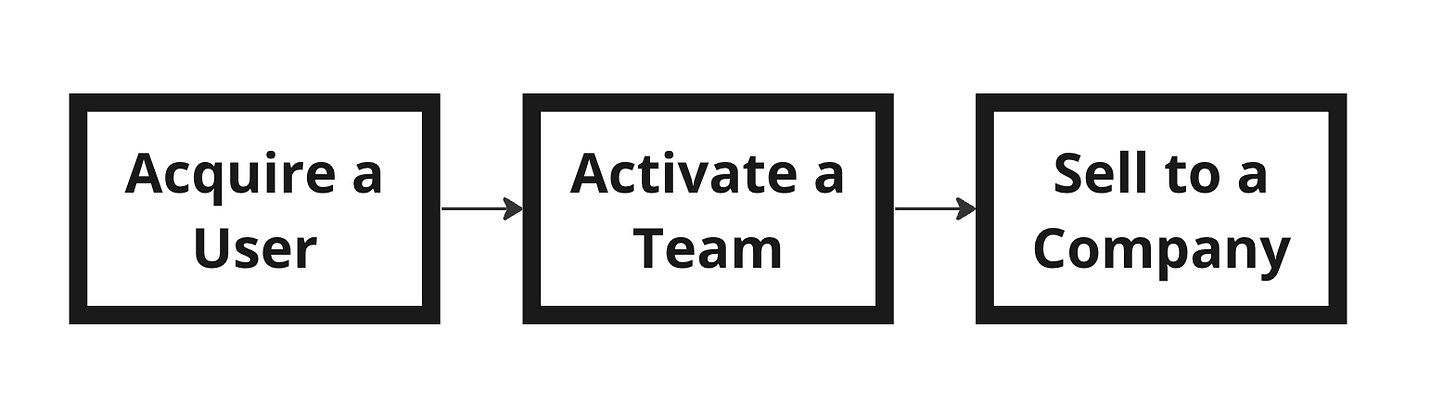

B2B Product-led self-serve experiences closely resemble consumer (B2C) look and feel. But there’s one major difference between B2B and B2C that will never change: B2B has to focus on nurturing a healthy, engaged teams to unlock sales upsell opportunity, rather than catering solely to individual users, which is a B2C focus. The best way to achieve this is to unlock team network effects, where the addition of each team member enhances the collective value of the team.

Another way to think about this: Acquire a user, but Activate a team, Growth the team so you can Monetize a company.

This means:

Set Acquisition, Activation, Engagement, and Monetization metrics on a team level.

Lead with a team use case, messaging, value, and plans.

‘Team’ plan with one user > ‘Individual’ plan.

Enable collaboration and multi-user adoption.

Create team network effects, where each additional new team user benefits the entire existing team.

Network effects can be achieved through collaboration or content.

More details in my post about ‘B2B Product-Led Growth Non-Negotiable: Team Network Effects.”

Team focus gives a necessary escalator for taking individual users all the way to enterprise value that sales will work on capturing.

Build Differentiation

But if you really want to scale hand-raisers, you have to think about what are you going to be selling through that sales channel. You have a few options:

(a) Product Differentiation: Managed Sales needs to have something different to offer from self-serve. At a minimum, this is something like features for admins or economic buyers. For Example: Compliance. Single Sign On (although that’s increasingly self-serve lately). Tiered Admin privileges. Security reviews. A lot of these have to do with security & control that admins/companies crave and evaluate their vendors against.

But if you want to actually scale this up, just having admin features won’t do it. Most of your self-serve usage consists of end-users, and no end-user says, “OMG, SOC 2 compliance! That would be amazing!” Self-serve product is used by end-user and they are much more interested in unlocking user functionality that exists in the Sales-only plan. For example: Integrations. Volume-usage limits. Any other product differentiation that you don’t really need in lower tiers.

(b) Services: Don’t underestimate this! Prioritized customer support, onboarding, or professional services to help with setup. But remember: Make sure to look into the cost dynamics of these, because the cost of sale becomes even higher, to ensure you’re still making good margins.

(c) Process: Okay, this one is not so great. This is offering the opportunity to have a human in the process to help rally the decision-making committee, help you through contract negotiations, assist with the PO process, bank transfers, etc.

But… that’s kind of the bare minimum. This is where the actual cost of bringing in sales comes from—you will have to walk customers through those processes. But it’s not really a differentiation. Just something you need to have.

(d) Pricing: This is the one you were probably expecting: Volume discounts that Sales can offer. Volume discounts are a beautiful tactic, but when they’re done in a silo without any differentiation baked in, it leads to pretty detrimental results with your product.

Why? Because without structuring things the right way, this approach can lead to you creating internal channel conflict between your self-serve and sales channels. For example: self-serve is static pricing, but Sales offers discounts—30%, 40%, 50%, 60%, 70%, 80% off! At some point, it really starts to cannibalize your self-serve.

You can prevent this by adding pricing lists that create floors for discounts on whichever volume tier the customer falls in. But be careful not to enter into a pricing war with yourself. A little discount is expected with sales if I’m going to buy a ton of volume and the product you’re selling doesn’t scale linearly—with added volume, it makes sense that you’ll more of a discount. But without product differentiation, it becomes a death spiral to the bottom: You start discounting yourself out of good margins.

Case Study: Miro. Not all enterprise motions offer discounts! At Miro, it was fascinating to see that the cost per user on enterprise contracts was… 3x the cost of the self-serve plan! That’s the ideal case scenario when you can actually sell the same unit in enterprise at a higher price. But the only way to do that is when you have very good differentiation between the enterprise product and the self-serve product, which warrants the price increase. This is particularly powerful if you have strong network effects within the organization where self-serve adoption has taken place—meaning that adding each additional user improves the experience of everyone on the team and you’ve created such a strong grip on that end-user base that they become price-insensitive to your costs. So you can push the prices up, as opposed to having to go down.

Pro tip! Don’t have your sales teams sell your self-serve plans.

Leave self-serve sku’s to be on its own, let it evolve on its own, being optimized and detached from your sales process. Self-serve will have to go through rapid iteration to stay relevant in the market, but once Sales starts selling self-serve, any updates have to go through the entire sales enablement process and retraining the sales organization. That’s a lot to do to support, say, a small price change or a small feature reallocation change you want to make on self-serve.

So, my recommendation: Make your managed sales sell their *own* plan. So, sales can check which entitlements they want, so they can choose prices they want, but it’s not the same SKU that you’re selling in self-serve.

Now the downer part…. Hand-raisers are not infinitely scalable. That’s because having hand-raisers assumes that there’s not only very strong usage… but you actually have a buyer in the user base that is hand-raising to your sales team… and that has a budget to actually complete the transaction.

So… eventually, you’ll realize that waiting for hand-raisers won’t get you where you need to go. So, what’s next?

4. How to think about Product Qualified Accounts (PQAs)

Who looks like a hand raisers, smells like a hand raiser, acts like a hand raiser, but IS NOT hand raising? Ding ding ding, that is your product qualified account!

The best approach to identify your first PQA’s is to take the data you have in your successful hand-raisers and model against it! Who else exhibits the behavior of your hand-raisers?

You really don’t have to get super sophisticated with data here, to start. You can literally just ask Sales: “What kind of hand raiser leads are you most excited about? Let’s find more accounts that exhibit those behaviors.” Start there with a simple top-down approach, and then go bottoms-up in a data-driven way as you progress.

Sales ICPs vs. Product ICPs

There’s a crucial distinction to understand, here: What Is Your Sales ICP (Ideal Customer Profile) vs. Your Product ICP? A lot of companies miss this. They say, “Hey, every single product user is subject for sale.” Not true! You might have freelancers in your product or you might have some agencies or students—they are most definitely not targets for your sales motion.

So, even though your self-serve product will have its product ICP, your sales team needs to have a separate sales ICP—so, who is your ideal customer for sales?

In thinking about the difference, consider that a Sales ICP generally depends on the following factors:

Company size: So, if the product ICP is “Anybody with B2B intent,” then the Sales ICP might be “Anybody with B2B intent and a company size of over 200 employees.” Why is this piece important? From a company perspective, a contract with a company with 200+ employees is more likely to hit a (for example) sales floor of $20k that we have for our sales reps. But for the sake of your relationship with those sellers, too—if you send Sales a company of 5 and their budget is a thousand dollars for the year, you’re going to have a bad time. “WTAF are you doing? Why are you sending me this garbage lead!?”

Geo: Pretty straight forward: Sales defines specific regions in which they are going to source more leads.

Industry: Once again, pretty clear: If sales wants to focus only on X industry, because that’s where sales efforts are more fertile.

Identifying PQAs within your ICPs

Once you’re clear on your Sales ICP, you can start looking for Product-Qualified Accounts. As I said before, PQA is just an account that is acting like it’s going to hand-raise, smells like it’s going to hand-raise, looks like it hand-raises, but it’s not hand-raising. PQAs are usually determined by volume of usage, velocity of usage, breadth of usage, or behavioral aspects.

Note: Always, always start with Volume, Velocity, or Breadth of Feature Use! Never start with just Behavioral. Behavioral elements are good overlays, but they’re not a good first starting point.

Here are some examples:

Volume: My product is measured on a user basis, and I’ve reached 10 users in the product.

Velocity: This would be velocity change in volume of usage. An example, using Dropbox: Say I’ve uploaded a document every single week. And then, all of a sudden, yesterday, I’ve uploaded 25 documents. Or, if I’ve added one user every single month, but yesterday, I added 50 users. So, that’s a very stark velocity change in usage. This is a really wonderful trigger, meaning something has happened. That might be a good time for sales to get involved.

Breadth of feature use: Usually the more functionality people are using in your product, the more likely they are to get so much value out of your product that they’ll be interested in spreading it across the rest of the organization.

Behavioral Triggers Are a Bit More… Fluffy. “I’ve attended a webinar” or “I landed on an Enterprise Landing Page” or “I’ve visited Terms of Use pages” - these not really usage-based. They’re just situations where someone is generally indicating their intent in some other way. Behavioral trigger can be very powerful, but think of them as amplifiers of the product usage triggers.

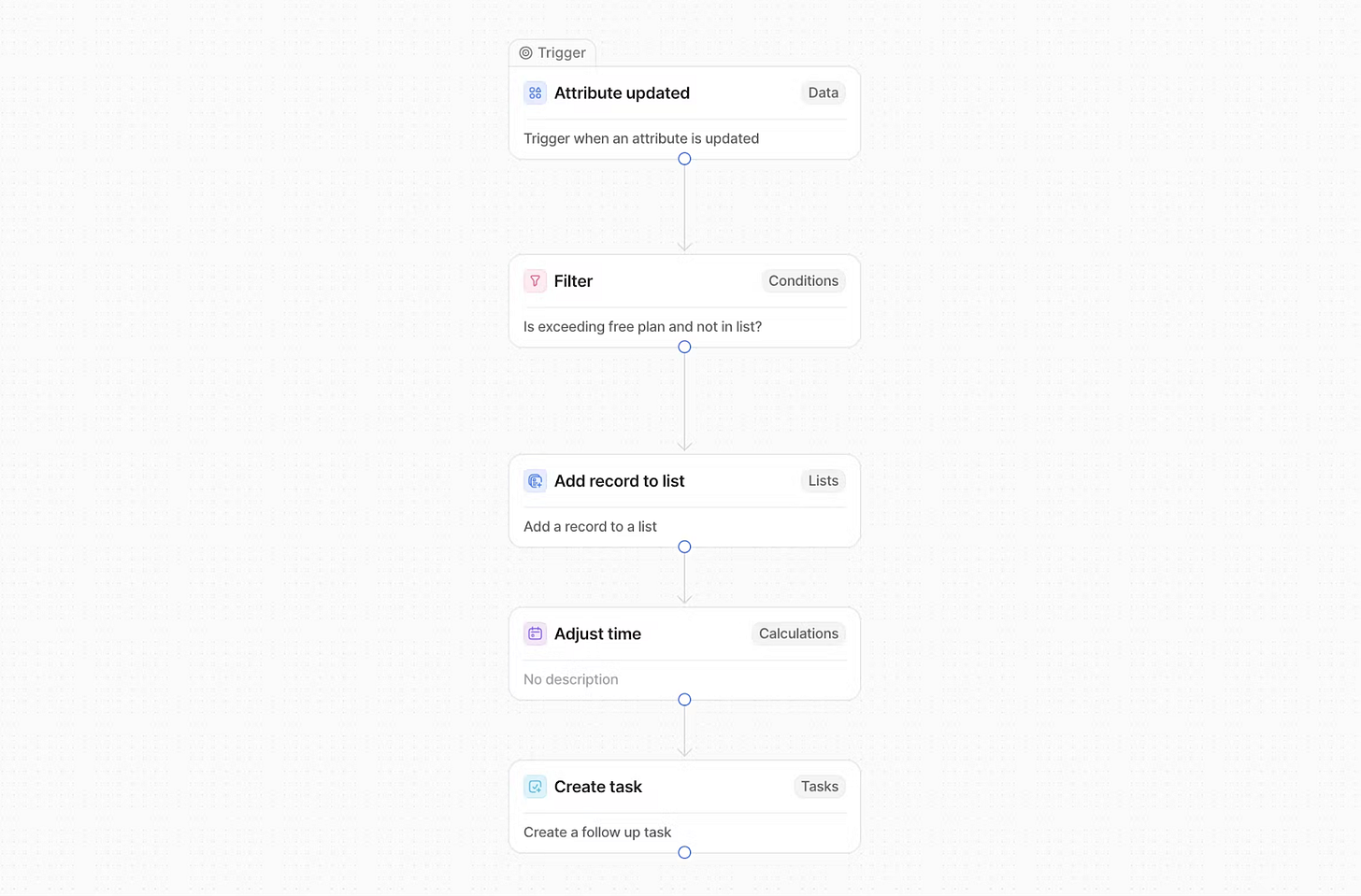

PRO TIP: The best Growth teams are automating this process.

When a user hits a particular threshold, this should trigger a series of actions for your team to immediately make the most of this moment. Check out how Attio does this with their automation templates, specifically for PLS!

Important notes:

(a) PQA is nothing more than right time to inject sales human into the account. This does not mean that the account is going to be ready to close because, in addition to timing, you also need to have the right person to talk to, know right things to say, and know where to say it. Finding the right person to talk to is the biggest hurdle… which brings us to the next section.

(b) Since PQAs are usage based, Product or Growth Product teams need to take on the accountability of getting Sales ICP account to the PQA stage. Meaning:

The product is accountable for both self-serve free and paid user health

The product is accountable for the self-serve revenue target if self-serve payment is available

The product is accountable for the pipeline by growing PQA’s

5. How to progress from Product Qualified Account to Product Qualified *Lead*

Product Qualified Lead (PQL) means you actually have an economic buyer in the account. To understand that, we need to define “economic buyer.”

The economic buyer is usually the person who actually can make a purchasing decision. They are the decision maker and/or budget owner. Economic buyers are usually defined by their departmental role—often, they’re in IT, but not necessarily. They can be departmental heads. Second of all, they have a certain seniority—maybe manager or Director, definitely the VP or Chief level. If you have that type of person, it actually becomes a true PQL and you send that customer’s contact to Sales, so Sales can apply their magic.

How do you know if you have a buyer in your user base? You can use 3rd-party data or… just ask your customers in the onboarding via profiling quiz.

This is my go-to list of attributes to include in the profiling quiz:

Read more in my post on Profiling: The onboarding step that transforms your growth efforts.

But most of the time… you don’t actually have any PQLs in your PQA. So you have a bunch of end-users, but there’s no actual buyer in there and your sales motion will look something like this:

So, what do you do there? Not all is lost! At least, not most of the time. You may still have a champion inside the account.

Working with a Product Qualified Champion

A Product Qualified champion is a super user who often introduced your product to their business and is very passionate about it. You can identify them by their high usage or a strong NPS score, indicating they're likely to refer your product.

Now, you cannot go to champion and say, “Hey, what's your budget? How can we close the sale?” But you can leverage this champion to find an economic buyer inside the organization. Note: This is one of the trickiest sales plays! Because sales reps are trained to talk to economic buyers. And here, you have an end-user that you need to leverage to find an economic buyer. And it's a completely different playbook. So you almost need to partner with them as opposed to sell to them.

But… if you make it work, it works beautifully. Because then that end user actually becomes your salesperson inside the organization. I've seen companies go as far as to send their sales deck and sales pitch to that end user for them to go and present it on their own internally, because that works much better than bringing your sales rep into that process. But if you can leverage those, it’s very important to mark them differently in your systems just because you shouldn't confuse them with an actual PQL. Those are very different sales plays that you should be going after.

When all else fails: Bring on the top-down motion.

But then there’s a 3rd situation: There is no economic buyer or champion lead. But you do have really good usage, indicating that this account is ready for sales upsell motion. And this is where your marketing and sales should be doing their magic.

ABM & Demand Gen teams - go find that buyer. This play is especially relevant in a larger segment account like enterprise (1000+ employees). That’s because there can be many degrees of separation between end users and decision-makers. And often they don't even know each other. So that's why enabling end users to do anything may not work, because they may not even know who to go to, even if they are a champion.

This becomes a lot more like a top-down traditional sales motion where you go and find the buyer or potential buyers out in the wild. But instead of giving them a cold pitch of saying, “Hey, my product is gonna solve X, Y, and Z for you,” you have a much more personalized pitch that you can give them. You can say, “Hey, your team is already using our product! And getting this much value out of it. Would you like to chat more?” And you can throw some of the usage numbers at them, which becomes a very powerful icebreaker.

So instead of just having a cold outreach, you have a warm outreach, powered by data usage that is already happening inside that buyer’s organization—as you might expect, this usually gets you much better open rates and much better ability to get interest, which allows you to actually scale that motion and sell.

However, there are a couple of caveats:

Beware of an angry IT. Be careful if your economic buyer is IT or a Chief Information & Security Officer (CISO): They are gonna be pissed if they find out there is a ton of “illegal usage” happening inside of the organization of some product. I've seen examples where the product or software usage has gone too far. So by the time it gets to the CISO or IT found out, they got so mad that it ran away from them that they ripped the product out. You don't want to be in that situation. So try to nurture them early.

Ring fence small sales team to experiment first. Whether you introduce a new motion or a variation of it - try to think about it as an experimentation and a new channel. Instead of just piling it onto the existing sales reps, create a ring fence sales team. They can go and experiment with this and see if they can actually land it. Because if you're gonna try to rock the sales mothership with an unknown type of lead source, it's very unlikely that they're gonna engage, because they're very quota-oriented, and they have no incentives to go and try out something new as opposed to just continuously trying to mine for what's already there. Ring fence sales teams are a fantastic way to introduce every single new variable of product with sales.

6. PLS Incentives & Timelines

Product Led Sales incentives are often very different, vs. Sales Led. Sales Led is very heavily focused on the average contract value, or ACV, and that's because the cost of acquisition is super high and all loaded up front. So we try to make up that cost of acquisition as much as possible by closing the biggest deal possible and then working on utilization afterwards.

Product led sales are quite different—you already have some usage going and with sales, you’re just trying to get through the sales floor, focusing on continuous expansion. So most of the contracts that you're gonna close in PLS at the beginning are going to be at the sales floor: those $10k, $12k, $15k deals. And that's why a lot of the Product Led Sales teams are actually not incentivized on ACV or dollars—they're incentivized on the number of logos that they're closing.

So their quotas are logo-based. Note: that’s not new logos to the company, it’s new logos that they are able to upsell from self-serve.

And then the actual, even harder part comes: How can you expand on them to get them to that really large ACV that you would potentially get top-down? I've seen in multiple companies where, 2 to 3 years in, these deals are exceeding the average ACV of top-down deals… but it does take 2 to 3 years.

So, you can’t compare ACV’s of top down sales and product-led sales. While the Sales-led motion gets “immediately” higher ACVs, you have to wait a long time until that account ‘ripens’ and is ready to buy in order to take the Sales-led approach. On the other hand, you can get into the company a lot sooner via product-led growth with the end user. This is well before you could have ever engaged with the buyer, because they're not even feeling the pain by that point. This allows you to establish the relationship A LOT sooner, box out the competition, and then apply product led sales to grow together with the customer. But maybe the best part? You don't have utilization issues afterwards! So it becomes a very, very healthy account, with good retention and very good Net Dollar Retention.

Conclusion

Product-Led Sales is not a simple matter, but there is a method to the madness. If you use the structured approach I’ve outlined, you’ll be way ahead of most companies.

Happy PLS-ing!

Thanks again to Attio: If you’re looking for a CRM that works for your go-to-market motion, check them out:

Edited with the help of Jonathan Yagel—check out his awesome Substack.

Love the article, Elena! Just a quick heads-up—the Attio link to the article on transitioning out of founder-led sales doesn’t seem to be working.