So you want to price your AI features…

The zero marginal cost era of software is over - let's review the best strategies to price your AI functionality.

This post is written by a wonderful Anh-Tho Chuong CEO of Lago. I don’t do many guest posts in my newsletter, but I couldn't have written this better myself. Pure gold!

Tech companies everywhere are having some version of this conversation:

Product: “Behold! Our shiny new AI feature. It does… [something smart].”

Growth: “Sick [yes, they are a millennial]. Shall we just include it in our existing plans?”

Finance: “Wait - this thing burns money faster than AWS on Black Friday. What’s the plan to make money?”

Everyone: Staring into the abyss of pricing models 😐

Yes, we can add value for users with AI. Yes, we can get people to use it. No, we have no idea (yet) how to charge for it.

Let’s face it: The zero marginal cost era of software is over the minute you touch LLM APIs. AI has real COGS and it is something we in SaaS will have to learn to deal with.

Pricing and monetization are one of those things we didn’t worry about too much in the 2010s. Most SaaS pricing was $5-20/month/user and you’d put some usage restrictions on each plan. But those barriers rarely followed from the company’s economics. They followed from user behavior. And the paywalls were placed where users were most likely to upgrade got the most value.

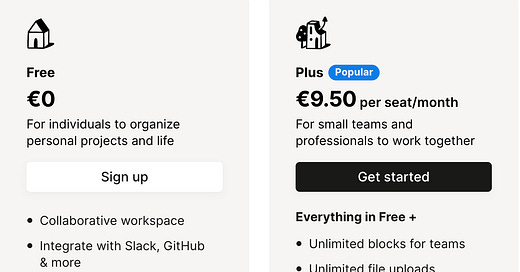

Take Notion for example. It doesn’t cost Notion much more whether you have 12 guests than to have 10 guests in your Notion workspace. But if you have more than 10 guests, you’re probably not an individual or school project, so Notion decides you need to pay up.

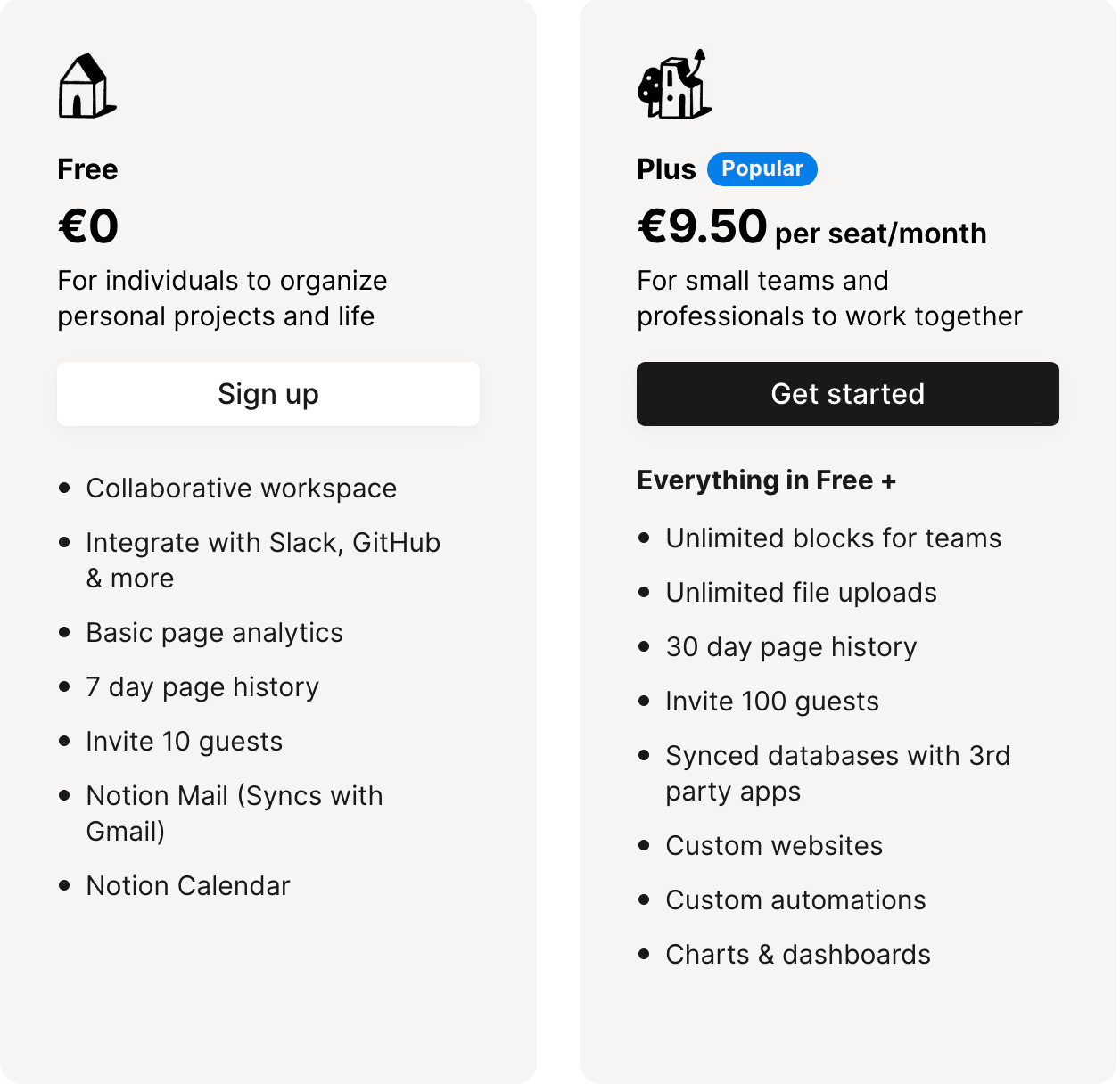

Compare that to AI video company Synthesia. For them, it absolutely makes a difference how many AI videos you create - because inference is expensive!

This is a reality for anyone using AI in their product: You need to restrict usage because if you don’t, a single user can *literally* bankrupt you.

Even if you rule out outliers bankrupting you, AI usage quickly eats into your margin if you don’t constrain it. Before AI, zero marginal cost made 75%+ margins common in SaaS (without much difference between power users and occasional users). Now, usage impacts your margins a lot more.

That’s why pricing models are evolving. There’s AI credits, pay-as-you-go, rate limits, etc. So how should your pricing evolve once you’ve shipped an AI feature? And when should you modify it vs. completely revamping pricing?

That’s what we’ll tackle today.

The different AI pricing models

If you spend enough time on LinkedIn, tech Substack or in the right group chats, you’ll see some people insist that subscriptions are dying and software will all be priced on usage/outcomes soon.

The “everything is changing and we’re never going back” crowd is rarely right (remember when Hollywood was going to be disrupted by NFTs? Or when all of manufacturing was going to be replaced by 3D printing?)

It’s true that pricing is adapting to AI being expensive, but you also don’t want to blow up your existing business prematurely. That’s why we’re seeing more hybrid models emerge. And my bet is that hybrid pricing will be more common than pure usage-based pricing, because:

Companies keep recurring revenue by continuing to price in subscriptions and limiting usage instead.

Customers have more cost control and can easily get the cost approved.

Companies can increase NRR and LTV when accounts grow their usage.

Customers can grow without costs suddenly multiplying (as they might in traditional SaaS when moving from a startup plan to an enterprise one).

There are three most prominent types of hybrid pricing models, which append AI to existing subscriptions:

Bundled AI usage: Your plan includes a fixed amount of AI usage. Once you hit the limit, access stops or you pay extra.

AI credits: Your plan comes with credits to use on AI. You can buy more if needed.

AI add-on: AI isn’t included by default - you pay extra to unlock it.

There is also a world where you blow up your traditional pricing model and go all in on the AI - we will cover that too!

Bundled AI usage

This is the model companies like Canva use. You get AI usage included in your plan. After that, you either can’t use the AI features anymore or need to pay an overage (i.e. a usage-based charge for extra AI usage).

Benefits:

Pricing is simple for users at first glance, making it easy to buy.

Revenue and usage are predictable for companies.

No big change in models.

Downsides:

Users aren’t used to being locked out of a feature after they paid for a plan.

Customers might not understand and complain about overages.

Hard to distinguish between intensity of AI tasks.

This last point is important: AI cost scales linearly with usage. So it’s more expensive for OpenAI if I use ChatGPT to write a novel than if I ask it for a pumpkin soup recipe. This is fine for Canva (images tend to be uniform and you can easily measure one image generation). But imagine you sold an AI customer support chatbot. If you included 200 AI chats per month, you’d pay the same if a user just says “Does this actually work? Lol” vs. if a user has a long customer support conversation. That makes calculating your margin a lot harder!

This model works well for a product like Canva because it’s not mission-critical. No Canva customer is relying on Canva’s AI features to serve their own product.

AI credits

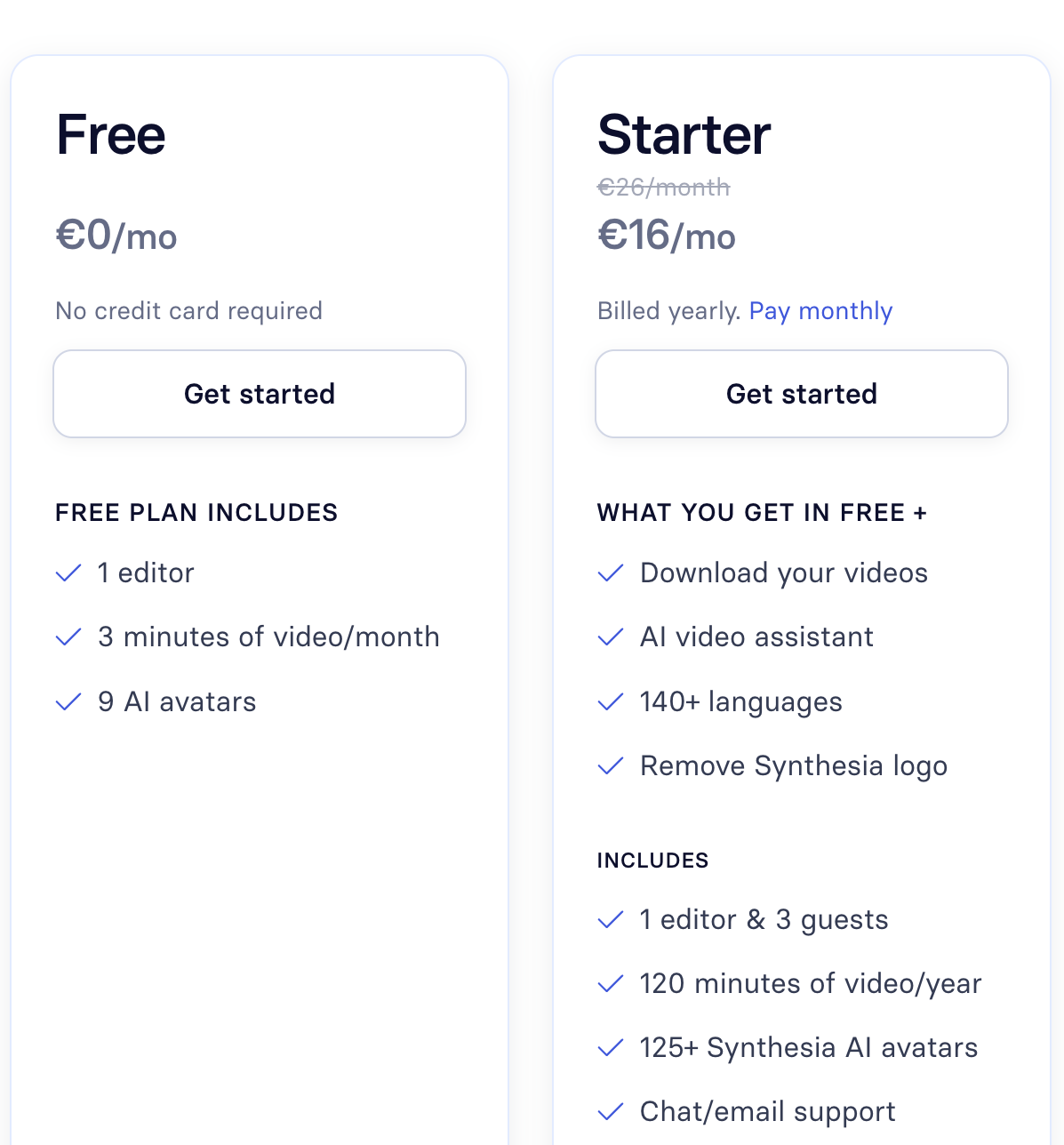

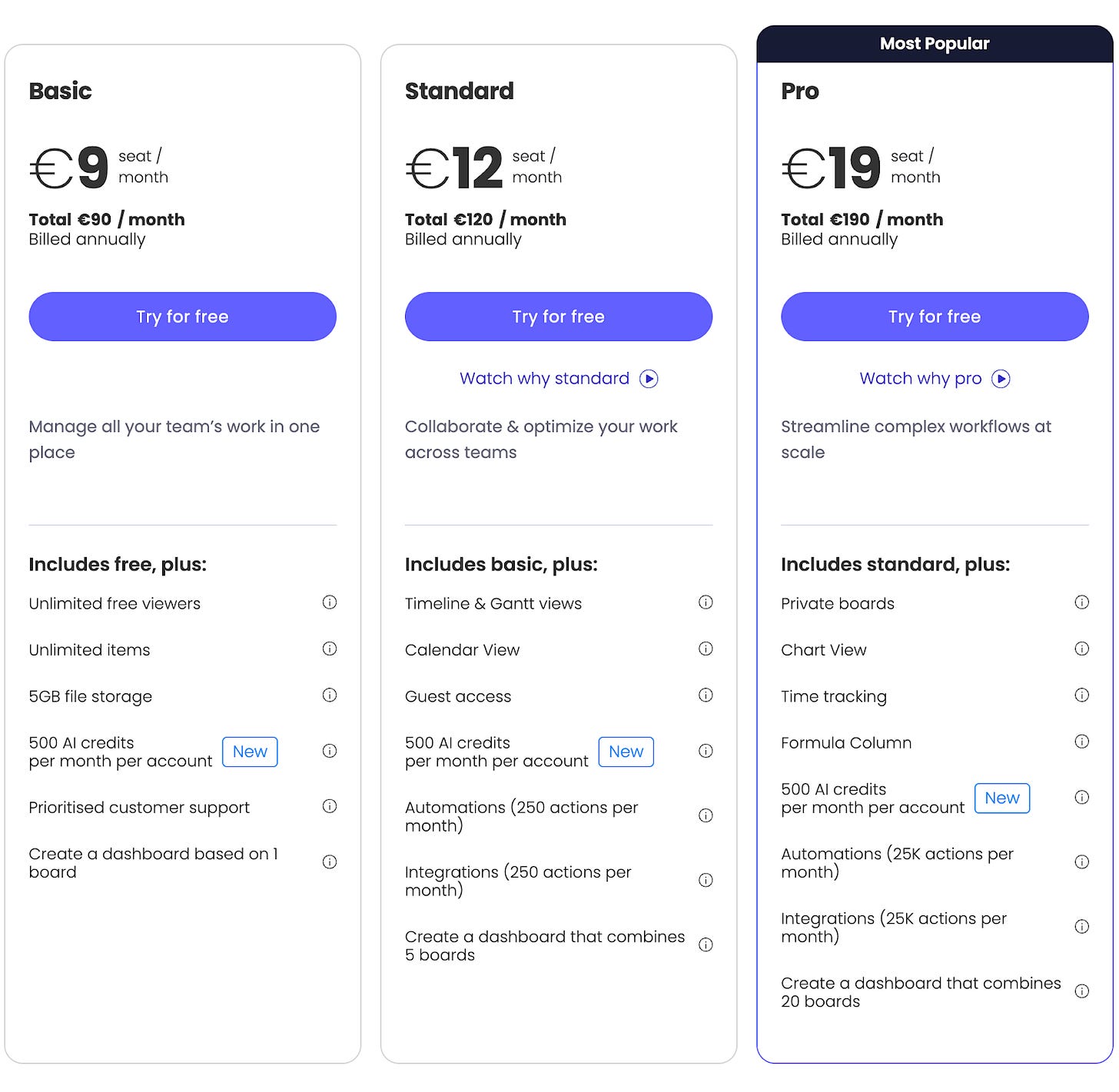

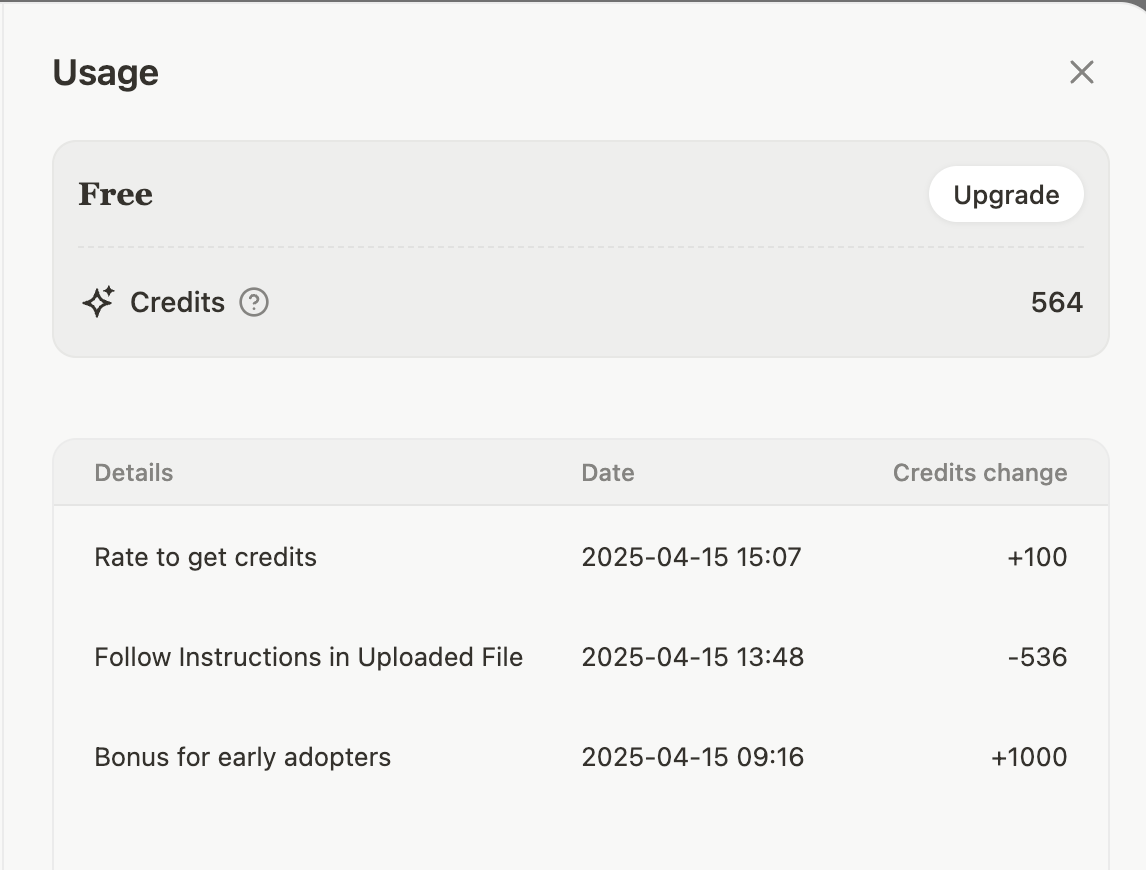

Credits are a similar, but different way of pricing AI products. Essentially, a subscription (or a package) allows users some amount of AI credits. Monday.com recently added AI credits to be included in subscriptions:

Credits are a controversial pricing strategy:

On a positive note: Credits offer cost control (since users have to top up if they run out, they never spend money without knowing it) while companies benefit from being compensated in advance for potential future usage.

For companies, credits are a way to hedge a larger spread of queries: Different Manus tasks consume varying amounts of compute and tokens.

If I had 5 queries included and could spend those either on “find me a recipe for chocolate chip cookies” or on “do competitive research on the usage-based billing space, use a reasoning engine to determine which features the incumbents are lacking and then prototype that feature”, Manus would have horrible unit economics.

Another positive aspect of AI credit pricing is that users can spend them on multiple products/features that consume credits differently (instead of needing to monitor multiple usage limits).

But on a negative note: Credits are confusing because each feature can cost a varying number of credits, depending on how “expensive” it is to run. Take Manus, which starts you off with 1000 credits. But after completing a task, you may find yourself missing half of your credits! And now you have no idea if this was an especially intensive task or how many credits the average task consumes.

If you run another task, will it run out of credits? Will you get an overage bill? Will it refuse to continue? You have no clue!

Benefits of AI credit pricing:

Hedge against usage differences.

Cover multiple products.

Get paid in advance.

Downsides of AI credit pricing:

Often unclear how credits are spent for users.

Users might feel like they’re wasting money if they have a mountain of unused credits.

Need to maintain billing infrastructure and have new products fit into credit pricing.

AI as an add-on

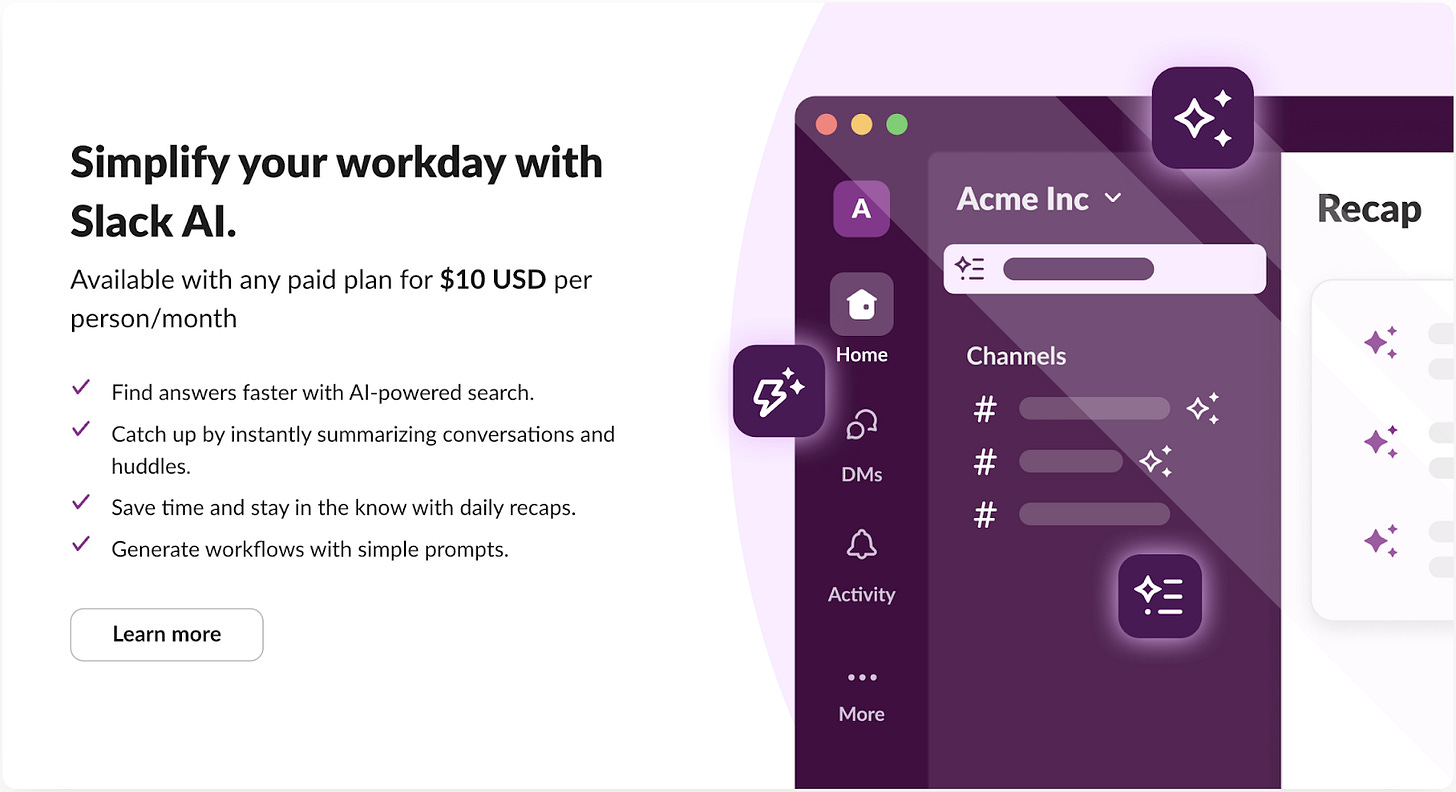

Some companies sell their AI features as an add-on to their regular products. Slack and Notion are the best examples here:

Here’s how it works: You get AI features in the app with more or less unlimited usage for an extra monthly/yearly fee. While unlimited usage will create some spread in the margins between customers, companies that do this will typically see similar-sized usage.

Slack AI will never have to write a novel or use a reasoning engine to build an app from scratch. Sure, the daily recap at Salesforce takes more inference than one at a Series A startup, but the difference isn’t as big as with a general purpose AI agent like Manus.

Benefits of AI as an add-on:

Easy to buy (no need to worry about plans).

Simple for users because there are no restrictions.

Guaranteed revenue for companies.

Downsides of AI as an add-on:

Downside from higher usage of the features.

Have to overcome the hurdle of customer finding and buying an add-on.

Often doubles the price per user per month.

Only available for companies that already have a working, non-AI product.

When (and how) to transform your pricing with AI features

AI doesn’t threaten companies like Slack and Notion. It might affect their business, but it’s not an existential threat.

Other companies are more threatened. Take Intercom, whose leadership is outspoken about the need to not only add AI to your product, but to reinvent your entire business with AI at the core.

As Des Traynor put it:

“Generally speaking, when something like this happens, it’s like an extinction moment. It’s like a meteorite hits your industry and some will survive, but not all.”

This is especially true in customer support, which is one of the jobs AI threatens most. If Intercom kept charging customers for seats in shrinking teams, their business would have crumbled.

Instead, they built Fin, a customer support AI agent that charges $.99 per resolution. Unlike Slack or Notion, Intercom now positions itself completely as an AI support company.

The “per resolution” pricing is novel and an example of outcome-based pricing. It’s also a rare example of outcome-based pricing actually making sense:

The outcome is clearly defined and easy to measure (deflected support tickets)

There’s a finite amount of work (inbound support chats) so the AI can’t run wild.

For human support agents, Intercom now offers an AI-powered inbox with an optional AI copilot as an add-on.

This is what a complete transformation of product and business model in the age of AI looks like. Intercom used to rely on a growth lever that was guaranteed to happen: As companies grew, they’d hire more support agents, which meant Intercom sold more seats. AI completely broke that lever - and Intercom adapted by charging per support resolution.

Transformations like these are never a simple pricing change. They’re full-company transformations that affect product, GTM and just about everyone else.

So if you’re in a category that’s threatened by AI, a transformation like this may be required. If you do this, your pricing and monetization need to evolve with it.

Why this is harder in practice

Aligning on the right AI monetization/pricing model is hard, but shipping it is even harder. If you’ve ever been part of a monetization/pricing project, you know these things always take way longer than initially planned.

It’s not because individual parts are hard. An events API (to capture usage), aggregation (to compute usage into a charge) and generating invoice PDFs are all relatively easy. These parts of billing look like a thing you have an engineer do in a week and call it a day.

But then you run into edge cases. If you’re sunsetting a credit system for subscription pricing, how will users grandfathered into credit pricing pay for new features? If you take on a customer from Serbia, how do you stay compliant if local regulations change? If, if, if, if, if, if.

This is how companies end up with entire teams of engineers that do nothing but work on the billing system (which, by the way, has or will become too complex to ever replace). This might sound like a one-time horror story, but it’s happening right now in a ton of companies.

There are easier options now that are more modular and relieve you of that burden - so that you can ship your new pricing and monetization faster (and without needing to hire 12+ billing engineers).

Wrapping up

SaaS pricing is almost always “per month, per user” or some variation of it. But when cloud computing first became popular, there were weird pricing models nobody remembers: Salesforce used to charge by the login, which meant you basically had to buy entry tickets to your Salesforce instance. Run out of logins? Nobody can log in until next month. (funnily enough, you can still purchase this, probably because someone, somewhere is still grandfathered in on that plan)

This sounds silly now (and it is), but that was how companies experimented with monetizing the new paradigm of cloud computing. AI might be in a similar phase now, where we’ll view some of today’s AI pricing models as silly relics we’ll reference in newsletters.

If you only take a few things away from this newsletter, let it be this:

AI is expensive, costs now scale linearly with usage. Act accordingly.

Orient your pricing model around how you keep your margin, but also make it easy for customers to buy.

Your pricing model follows from your category and how customers use it (a production database that stops working because you used up your credits would be a bad product).

Get your billing/payment system ready to iterate on different AI monetization models (shameless plug - checkout Lago (Ahn-Tho’s company, which is an open source metering & usage-based billing platform that makes it *easy* to scale your AI pricing strategies).

This is a very timely article and you have done a very thorough analysis. Thanks for sharing this.

I want to add couple of other points that may be helpful

Customers want a fix budget and don’t like the variability. Even though Aws and Azure are usage based but they do annual prepaid contracts for that reason.

Companies need some way to predict their revenue streams reliably But with usage only it will take many months and years of data to predict correctly. Even Open AI has a fixed per month pricing as its primary revenue driver.

There is another one paid.ai but don’t think they are open source.