You should probably form a monetization council.

AI is reshaping traditional monetization models. Are you ready to act?

This post is sponsored by Schematic: Schematic gives growth and product teams full control over pricing & packaging - without code changes. Configure usage-based plans, add-ons, paywalls, and enterprise exceptions in minutes, not months.

As AI gets embedded into more products, value becomes tied to usage, not seats or features. Flat-rate pricing won’t make sense when one user generates 100x the load of another. Usage-based pricing will become the norm - especially in AI-powered tools where cost and value scale with consumption.

For now, we’re seeing a wave of AI credits slapped onto existing pricing and packaging - since most product integrations are still a work in progress. But that won’t last long.

I highly recommend beginning to lay down the foundation for the upcoming changes. And you should start with the most basic question of them all:

Who owns your pricing and packaging?

Sometimes PMM or strategy teams raise their hand - but they don’t own revenue targets. So they make a nice-looking doc or a deck, then sales and product are left to execute it and deal with almost guaranteed fallout.

But most of the time? There’s no owner - cue awkward silence.

And monetization related conversations end up going something like this:

or this:

This happens because monetization lives in the no-man’s-land between Product, Marketing, Sales, and Finance. Everyone touches it, but no one fully owns it. And since it directly impacts revenue, customer experience, and operational complexity, any change feels risky and political (oh so political!). So teams punt, delay, or bring in consultants - you know, those $500K Simon-Kucher contracts promising a la-la land of raining revenue, but delivering a desert of stalled growth.

But here are some hard truth about monetization: the core problem isn’t strategy. It’s ownership. Internally, no one actually feels responsible from end to end.

Product keeps evolving, but monetization stays frozen. Packaging stops making sense - externally and internally. The market moves on without you. Oof.

Growth teams feel this a lot. They're on the hook for revenue - free-to-paid conversion, retention, all of it - but they can’t touch the pricing page without 56 approvals and a prayer. They’re left optimizing around the edges, chasing local maximas while global impact sits locked behind a paywall... of organizational indecision.

Monetization changes? They come in two flavors

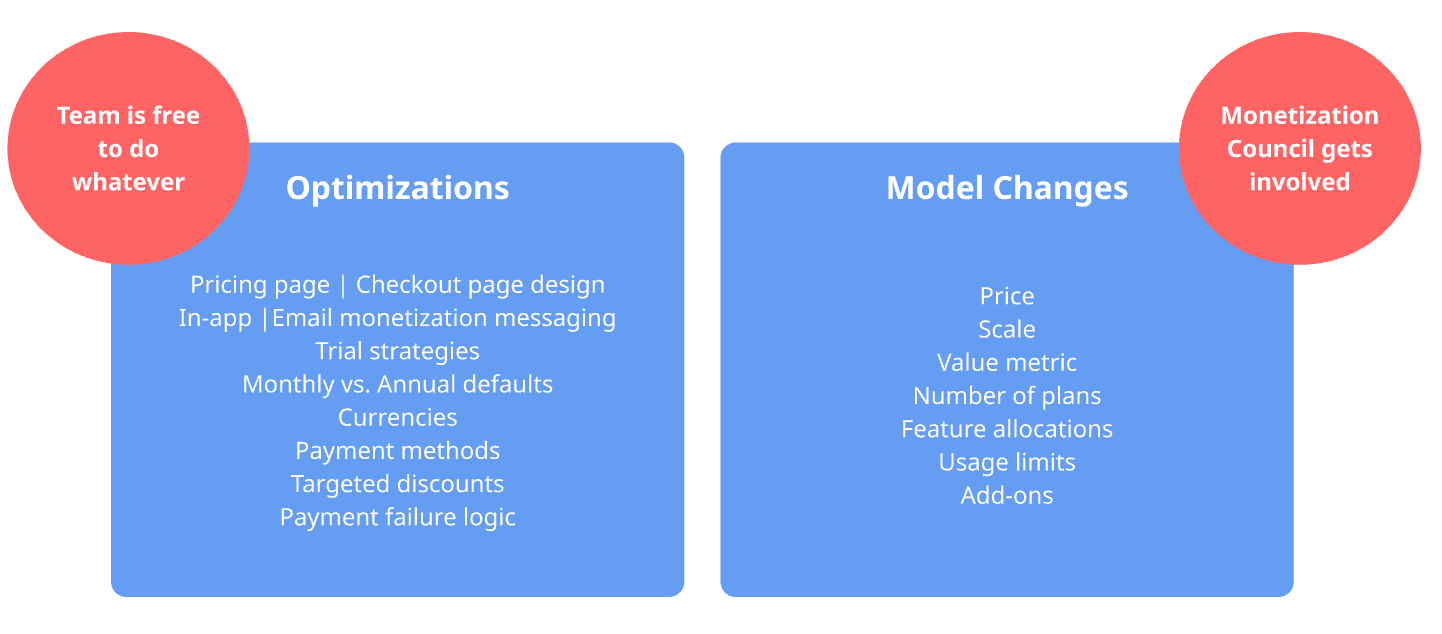

The first step to tackle this problem is to understand that not all monetization changes are created equal. We can divide them up into two streams: optimizations on the existing pricing and packaging and changes to pricing and packaging.

Optimizations

These optimizations don’t change the actual monetization model, they just optimize the customer’s interaction with it:

Redesigning the pricing page

Adding upgrade prompts in-app

Offering reverse trials and trial restarts

Changing the default payment from monthly to yearly

Adding a one-click button for auto-renewal

Adding additional payment methods to the check-out page

Supporting additional currencies

Giving targeted discounts (to students or at-risk of churn customers)

The organization should trust teams to own this, the same way it trusts them with other product optimizations. For a product, marketing, and growth teams to be empowered to do its job, they should have the autonomy to make all these changes without seeking approval.

Model changes

This second category is where things get more serious because now you're changing how the business makes money. Structural monetization changes include:

Price you charge

Value metric (per user, per event, per transaction, per ai credit, etc)

Number of plans and their names (including freemium)

Features included in each package

Usage limits

Add-ons

These decisions still need to evolve as your product and market do, but they require deeper conversations and levels of approval.

However, we’ve established that owning pricing is a mess at most companies. So, how do we go about getting approval on this? That’s where monetization councils come in.

Solving the accountability void

If you’re not actively evolving or experimenting with your monetization model, chances are your pricing has gone stale. That’s your cue to spin up a Monetization Council - a cross-functional group with real influence. Let’s cover the basics.

What?

Teams should have full freedom to make pricing optimizations - no red tape, just iterate and ship. For deeper model changes, a Monetization Council creates the structure and accountability needed to make smart, coordinated decisions. It ensures there’s a clear path to evaluate, approve, and implement changes that impact how the business makes money.

Who?

Bring together key stakeholders: Sales, Marketing, Product, Finance, and ideally the CEO. Keep it lean - 5 to 7 people max - to stay nimble and foster real discussion.

You need decision-makers in the room. This isn’t the place for proxies. If Product is involved, it should be the CPO, not a PM (sorry, PMs).

How?

A monetization council exists to unblock and accelerate monetization model changes with necessariy decisions. It brings together cross-functional leaders with real authority to:

Align on monetization goals and problems

Approve pricing and packaging model changes experiments

Ensure and prioritize smooth cross-functional execution

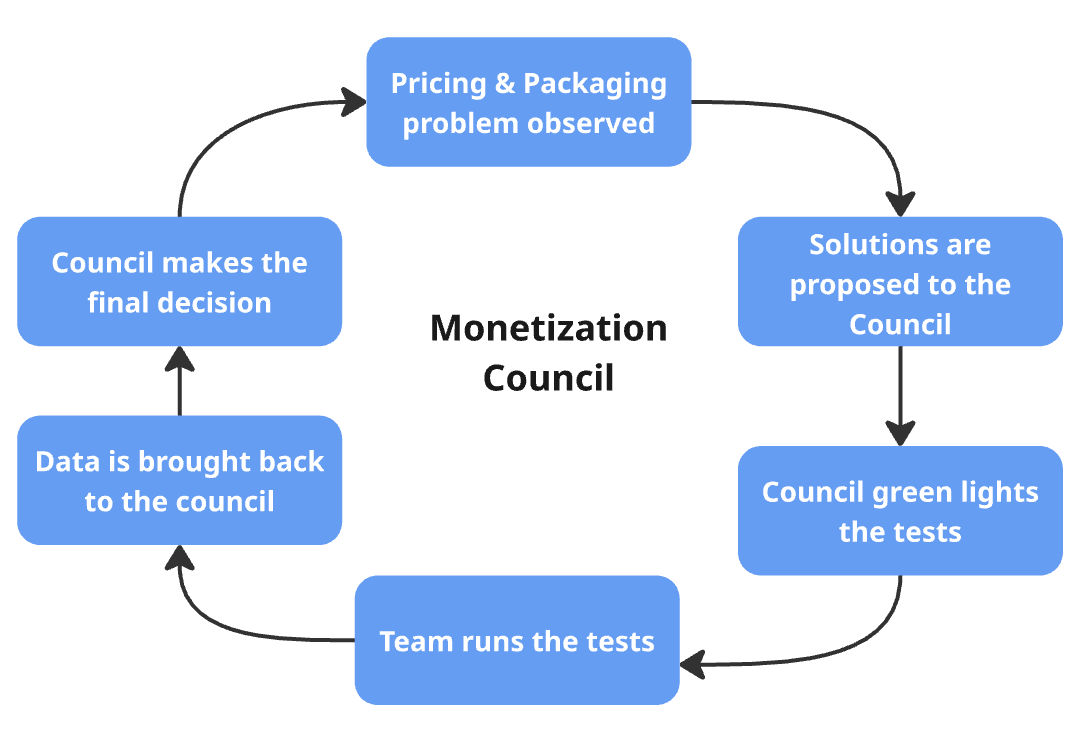

Make final data-driven decisions

Say your growth lead suspects the pricing is too high. Instead of debating it endlessly or hiring a consultant, the team can come to the council with a clear hypothesis, supporting research and a proposed test plan. The council reviews it, asks questions, and gives the green light. Then the team runs the experiment, gathers real data, and brings it back. That’s when the council makes the final data-driven call.

In other words, it creates a dedicated forum where monetization isn't everyone’s side project - it’s someone’s actual job.

Who should bring these topics to the council?

Whomever… But most likely growth, product, and marketing teams that own the revenue.

In my past lives, I’ve been the one holding these sessions. When I owned self-serve revenue, it was my job to surface topics. In the same way, if sales owns a revenue line and wants to update list pricing or tweak reseller terms, it’s on them to bring that in.

When should they meet?

Cadence depends on your stage. At a minimum, the monetization council should meet quarterly to do a sanity check. But if you’re actively iterating on pricing or packaging, weekly or bi-weekly meetings aren’t overkill - they’re essential.

Inaction is expensive

At the end of the day, the council is a tactic to bring the right decision-makers to the table, give it an ongoing cadence, and adjust the model all the time instead of doing it once in a blue moon and then suffering the consequences (Hi Netflix, remember your first price hike? Brutal. But props to them - after years of steady increases (9+ times), nobody even blinks now. That IS the point - make your monetization model a living breathing thing that customers expect to evolve over time.)

This matters even more now. With AI quickly shifting cost structures, value propositions, and user expectations, your monetization model can’t afford to stay static. You need to experiment more, learn faster, and adjust often. The days of "set it and forget it" pricing are o.v.er. You need a way to evolve without losing your mind - or your revenue.

So ask yourself: who owns monetization at your company? If you have to think twice, it’s time to form your monetization council today.

Edited with the help of Diana Bernardo.

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, vision, trust, truth, efficiency, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e

Monetization is quickly becoming a company-building discipline that demands full-time brainpower, and I think it sits between CPO and CMO. We're seeing too much change at the pricing model level, and the work is frankly too analytical and cross-functional to survive the meet-in-the-middle decisions you get from councils. This is the existential question for the business and it requires a strong and strategic point of view!